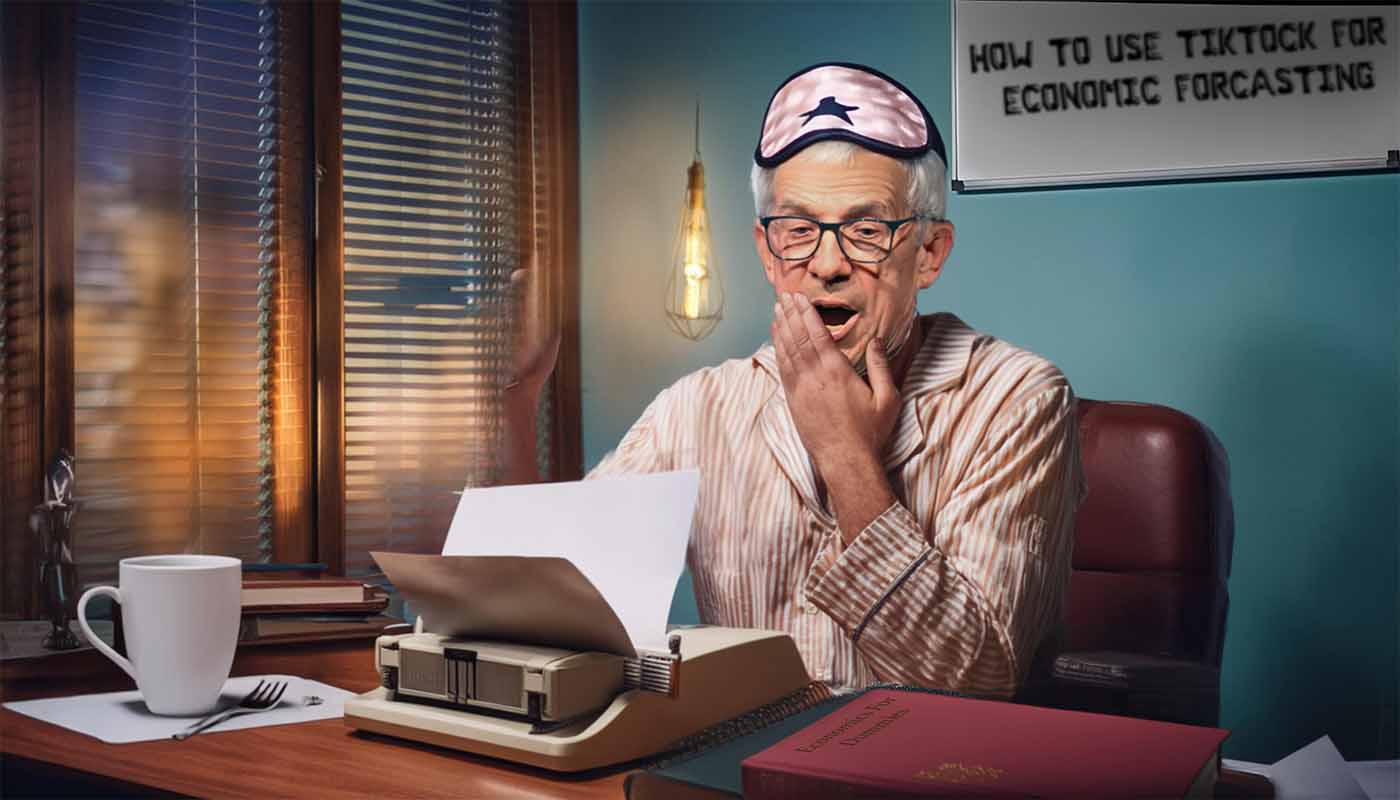

WASHINGTON, D.C. — In a startling turn of events, Federal Reserve Chairman Jerome Powell may have just woken up from a 200-year nap, discovering that the American economy is in free fall and that his shoes are now approximately 1.5% of their original value. According to sources, Powell, who recently emerged from what appears to have been an extended slumber akin to Rip Van Winkle’s, was reportedly startled to find himself in an economic landscape that closely resembles a dystopian video game where all the cheat codes have expired.

The revelation came after Powell awoke in his office to the sound of urgent emails and frantic phone calls about a stock market that was “uncomfortably close to just falling into itself.” At first, Powell assumed it was just another Thursday. However, when he glanced at a nearby financial ticker that seemed to be melting like an ice sculpture at a summer party, he was reportedly taken aback.

“I honestly thought I had just slept through a particularly turbulent week,” Powell said in an official statement. “Turns out I’d slept through several decades of economic turbulence, a global pandemic, and multiple recessions. It appears that the economy has become a bit like my old smartphone—extremely outdated and in desperate need of an upgrade.”

Powell went on to admit “hindsight being 20/20, I really should’ve bought an alarm clock. Paying attention to what’s been going on recently and reacting accordingly could’ve saved a few trillion in market loss. C’est la vie I suppose”.

Financial analysts quickly pointed out that Powell’s extended absence might explain several of the Fed’s more questionable decisions over the years. “It all makes sense now,” said Dr. Olivia Keynes, a prominent economist. “The bizarre policy shifts, the inexplicable interest rate changes, and the overall feeling that we’re all living inside a bizarre episode of ‘Black Mirror’ can all be traced back to our Chairman being in a deep, restorative sleep while the rest of us were frantically trying to hold the economy together with bubble gum and good intentions.”

Critics are already questioning the effectiveness of Powell’s reentry into economic policy. “It’s a bit late to start adjusting interest rates when we’re already knee-deep in a recession,” said Doug Larson, a frustrated small business owner. “It’s like trying to fix a leaky roof while the house is already on fire.”

Despite the economic chaos, Powell remains optimistic. “It’s like when you wake up from a long nap and find out you’ve missed a few episodes of your favorite show,” he remarked. “You might be a bit behind, but you can always catch up on the highlights.”

In response to the unexpected discovery, Powell has announced a new initiative to “relearn” modern economic theory, starting with a crash course on the basics of inflation and how to use TikTok for economic forecasting. In the meantime, he has appointed a special task force to assess the damage and to determine if the current economic situation can be fixed with an extra-large coffee and a brief motivational speech.

As Powell adjusts to his new role in a world where the Dow Jones doesn’t seem to recognize the concept of “rebound,” the public is left to ponder the larger implications of a financial system that might just need a lot more than a wake-up call.

“I guess sometimes you wake up and realize the world has changed while you were snoozing,” Powell concluded. “And sometimes, that world is a complete economic mess.”

UPDATE: Following the discovery, Powell was seen attending a seminar titled “Economics 101: What Happened While You Were Asleep,” and has reportedly started an online petition to reinstate high levels of quantitative easing.

Powell’s 200-Year Snooze Crisis Powell’s 200-Year Snooze Crisis